Over the last several weeks, millions of Americans have seen their income affected by the COVID-19 crisis. As the coronavirus spread, non-essential businesses were forced to shutter, leaving workers in limbo. This was especially troubling for the workers whose health insurance plans were tied to their jobs.

If the COVID-19 outbreak has jeopardized your health insurance coverage, you have a few main options to consider:

- Keep your old plan through COBRA continuation coverage

- Enroll in a new plan through the Affordable Care Act (Obamacare) marketplace

- Sign up for off-exchange health coverage

COBRA Continuation Coverage

COBRA, which stands for the Consolidated Omnibus Budget Reconciliation Act, allows you to keep the health insurance plan you had from your job for a limited time (typically 18 or 36 months). However, COBRA continuation coverage will have higher premiums because your employer will no longer help to cover the costs.

Your monthly COBRA premiums will be a maximum of the total cost of your health plan premium plus a 2% service charge. Depending on what your employer was covering, that could be an 82%-102% increase in healthcare costs!

You have 60 days to decide whether you want COBRA continuation coverage, starting from the original date you lost your job-based coverage or from when you received the election notice.

But before you choose COBRA continuation coverage, consider your other options. If you lost your job-based health insurance, you likely qualify for a Special Enrollment Period, which allows you to enroll in an Affordable Care Act plan.

Affordable Care Act Coverage

The Affordable Care Act, also known as the ACA or “Obamacare,” established health insurance marketplaces where Americans can purchase federally regulated and subsidized health insurance.

These plans are required to provide essential health benefits, including emergency services, prescription drugs, and preventive services. ACA plans must also cover treatments for pre-existing conditions like asthma, diabetes, or cancer.

An annual Open Enrollment Period for ACA plans takes place every fall. During that time, anyone can enroll in an ACA plan. But to get an ACA plan outside of the Open Enrollment Period, you must qualify for a Special Enrollment Period.

You can qualify for a Special Enrollment Period in a variety of ways, including:

- Changes in income (you lost your job, your work hours were cut, etc.)

- Loss of health insurance (you lost your job-based health insurance after being laid off or having your hours reduced)

- Changes in your household (marriage, new baby, divorce, etc.)

- Changes in your residence (moving to a new home, moving to the U.S. from a foreign country, etc.)

You have 60 days since you lost or expect to lose your qualifying health coverage to sign up for a new ACA plan. You may also qualify for subsidies to help pay for your ACA coverage. In 2019, 87% of ACA enrollees received premium subsidies!

Off-Exchange Health Coverage

Another option to consider is off-exchange health coverage, which includes:

- Short-term medical insurance

- Hospital indemnity insurance

- Health care sharing ministries

Short-term medical (STM) insurance provides limited coverage for up to 364 days (depending on the state) and can kick in as early as the next day. You can apply for STM plans year-round.

These plans are intended for people who need temporary health coverage, people who missed out on Open Enrollment and do not qualify for a Special Enrollment Period, and people who can’t afford major medical coverage.

STM plans are more affordable than ACA plans. They mirror what individual insurance plans were like prior to the Affordable Care Act. This may mean that they don't cover everything an ACA plan would; for instance, they may not cover regular pregnancy.

Most hospital indemnity insurance offers a daily cash benefit for in-hospital services. The cash payout is intended to help you with medical costs, as well as non-medical costs that could be associated with your sickness or injury—childcare costs, grocery deliveries, travel expenses to and from healthcare facilities, etc. Daily benefits can range from $200 a day to $1000 day, depending on your chosen plan!

Some hospital indemnity plans also offer cash payouts for other healthcare needs, such as doctor visits, ER visits, surgical procedures, lab tests, and X-rays. These cash benefits are fixed and vary by plan.

Depending on how benefit-rich your chosen hospital indemnity plan is, it could replace your primary health plan or act as a supplemental plan to help pay for medical costs not covered by a health plan (costs like deductibles, copays, coinsurance, etc.).

Most hospital indemnity plans have no waiting period for accidental injuries, but there may be a waiting period before your coverage kicks in for illnesses. Since hospital indemnity plans are not ACA plans, there may be limitations on pre-existing conditions.

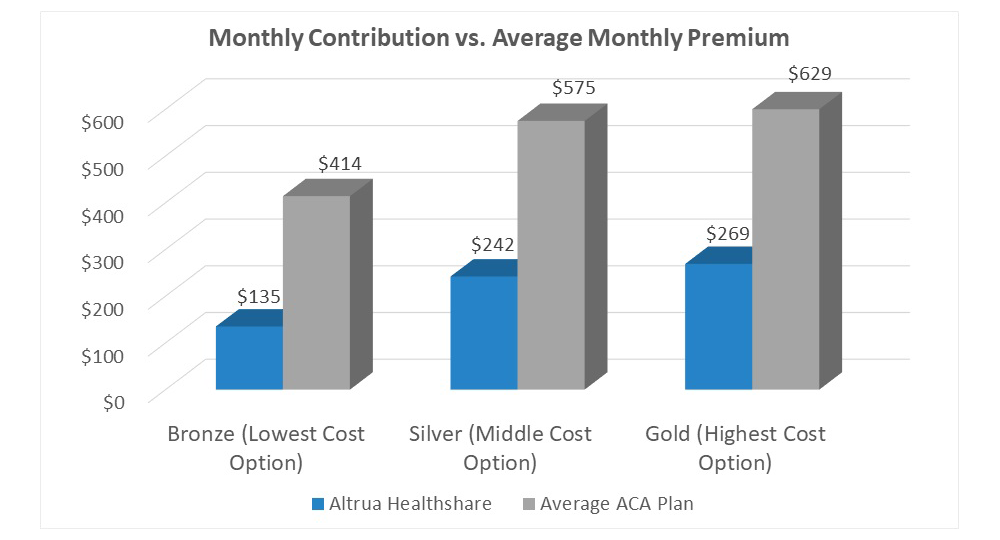

Health Care Sharing Ministries (HCSM) are another ACA-alternative option. In an HCSM, health care costs are shared among the members. If you receive medical care, the members of your HCSM will help to pay your bill. Likewise, your monthly contribution payments can go toward other members’ care.

HCSM plans are generally more affordable than ACA plans because HCSMs can require members to be relatively healthy and refrain from what they deem to be “risky” behavior, which helps to keep costs low.

Discuss Your Options with a Licensed Health Insurance Agent

When it comes to your health insurance options, you have a lot to consider. The good news is that all health insurance plans cover COVID-19 treatments, and some will even waive your out-of-pocket costs.

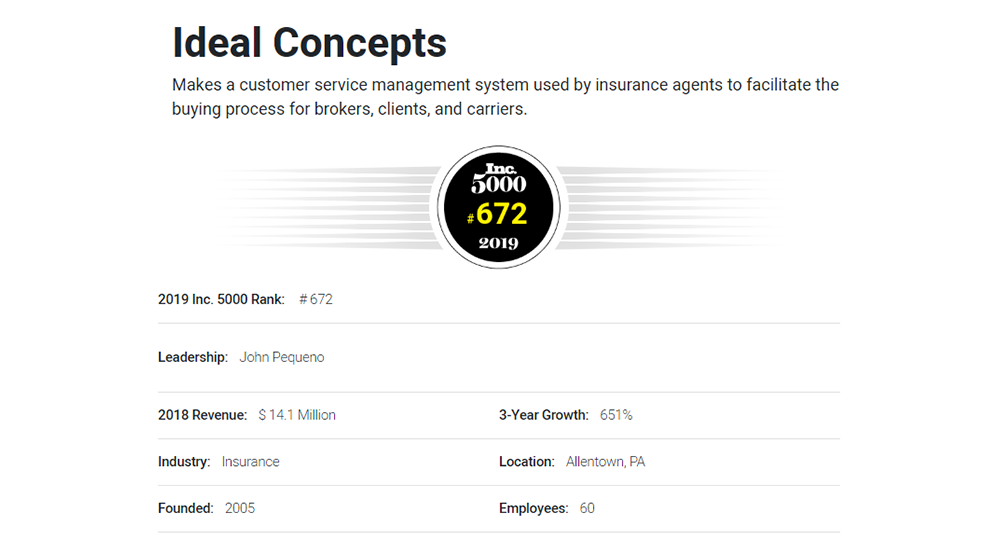

If you aren’t sure which coverage is right for you, our agency partner’s licensed insurance agent can help. Speak to a licensed health insurance agent by calling 866-WWW-iWEB or visiting iWebQuotes.com!